The Revenue Cycle Management of a provider begins the moment he schedules an appointment for a patient and ends when the accounts are reimbursed.

An efficient RCM cycle empowers a healthcare provider by minimizing denials, reducing days in accounts receivable, and increasing cash collection.

| It’s interesting to note that healthcare providers that optimize their RCM processes can possibly increase their revenue by as much as 15-20%. |

Let’s look at RCM in more detail.

Revenue Cycle Management (RCM) in medical billing is the entire process a healthcare provider follows to collect payment for services rendered. It involves everything from scheduling appointments and verifying insurance to submitting claims and following up on denials.

Essentially, it’s the journey from delivering healthcare services from start to finish to collect the payment for the rendered services.

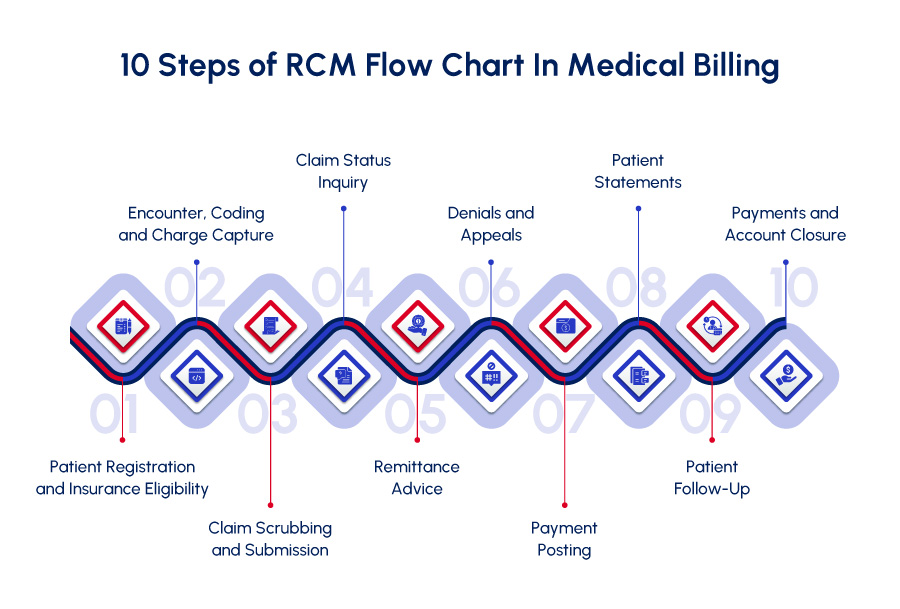

Steps of Revenue Cycle Management Flow Chart In Medical Billing

This RCM roadmap equips you with a clearer picture of the journey of RCM in medical billing and the efforts healthcare providers invest in ensuring proper billing and revenue cycle management.

Revenue Cycle Management is a complex process that involves several steps to track revenue and to ensure timely and accurate collections are made.

1. Patient Registration and Insurance Eligibility

The journey begins when an appointment is scheduled and the insurance information of the patient is obtained. This step involves:

➡ Scheduling and Registration: The patient books his appointment, either online, by phone, or in person.

➡ Pre-registration: The healthcare provider collects the patient’s demographic information, including insurance details. They may also verify eligibility for coverage with the patient’s insurance company at this stage.

2. Encounter, Coding and Charge Capture

During the visit, healthcare professionals document the care delivered, and the information is used for billing purposes. This step entails:

➡ The Patient Encounter: The patient attends the appointment and receives medical care from a doctor or other healthcare provider.

➡ Clinician Documentation: The doctor documents the visit details electronically in the health record system. This includes the patient’s medical history, what happened during the visit, diagnoses, any follow-up needed, medications prescribed, and lab tests ordered.

➡ Medical Coding: Specialists translate the clinician’s documentation into specific codes. These CPT, HCPCS, and DX codes explain the services provided and diagnoses made during the patient visit. Understanding payer guidelines and claim requirements is crucial at this stage to ensure proper reimbursement for the services rendered.

3. Claim Scrubbing and Submission

Once the coding is complete, a claim is created for the patient’s visit. It is then submitted to the insurance company for processing. It includes:

➡ Charge Entry: The billing team enters the charges for the patient visit based on the assigned codes into the medical billing system.

➡ Claim Creation: The claim is created electronically in your EHR system.

➡ Claim Scrubbing: Before submitting the claim, the billing team performs a “scrub” to identify any errors or missing information. This helps prevent rejections from the insurance company.

➡ Claim Submission: The claim is submitted electronically or via paper to a clearinghouse, which acts as an intermediary between the provider and the insurance company. The clearinghouse then sends the claim to the insurance provider for processing. There’s a chance the clearinghouse might reject the claim if there are errors. If that happens, the billing team will identify and fix the issue before resubmitting the claim.

4. Claim Status Inquiry

The provider doesn’t just wait for a check. A team monitors the claim status and follows up with the insurance payor if there are any delays or denials. Here’s how:

➡ Tracking and Monitoring: The billing team tracks the claim’s progress within the insurance company’s system.

➡ Inquiry: If the claim hasn’t been processed within a reasonable timeframe, the team may initiate an inquiry with your insurance company to understand the status and potential reasons for delay.

5. Remittance Advice

The insurance company reviews the claim and responds. Here’s what to expect:

➡ Payment or Denial: The insurance company may approve the claim and send a payment to the healthcare provider. Alternatively, they may deny the claim entirely or request more information.

➡ Remittance Advice: The insurance company sends an explanation of benefits (EOB) or remittance advice detailing the claim processing. This document outlines how much was approved, denied, and why. This information is crucial for both the provider and the patient.

6. Denials and Appeals

If the insurance denies a claim, the RCM process doesn’t end there. Here’s what happens next:

➡ Denial Review: The billing team analyzes the reason for the denial based on the remittance advice.

➡ Correction and Resubmission: If there are errors or missing information, the team scans, identifies, and corrects them and resubmits the claim.

➡ Appeals Process: For unjustified denials, the provider may initiate a formal appeal with the insurance company. This involves submitting additional documentation to support the claim’s validity. The appeals process can have multiple stages.

7. Payment Posting

Once the insurance company approves the claim and sends a payment, it’s recorded by the healthcare provider. This step involves:

➡ Payment Allocation: The billing team allocates the insurance payment to the specific patient and service. This ensures accurate financial records.

8. Patient Statements

After processing the insurance payment, any remaining balance becomes the patient’s responsibility. Here’s how they can be informed:

➡ Bill Generation: The billing team generates a clear and comprehensive statement for the remaining balance after insurance coverage.

➡ Statement Delivery: The statement is sent to the patient, typically by mail or electronically depending on their preference. It details the services provided, associated charges, insurance breakdown, and any remaining patient responsibility.

9. Patient Follow-Up

Not everyone can pay their medical bills immediately. The RCM process addresses this with:

➡ Patient Communication: The billing team may reach out to the patient regarding the outstanding balance and offer various payment options or financial assistance programs (if available) to help them settle their bill.

10. Payments and Account Closure

The journey concludes when the payment is reimbursed. Here’s the final step:

➡ Payment Processing: Once the payment is made, the billing team processes it through the system, reflecting the updated account balance.

➡ Account Reconciliation: The team ensures all payments and adjustments are accurately reflected in the patient’s account, finalizing the billing cycle for that specific service.

This simplified breakdown provides a general understanding of the RCM flowchart. In practical terms, the process can be more intricate and complex, with additional steps depending on specific circumstances.

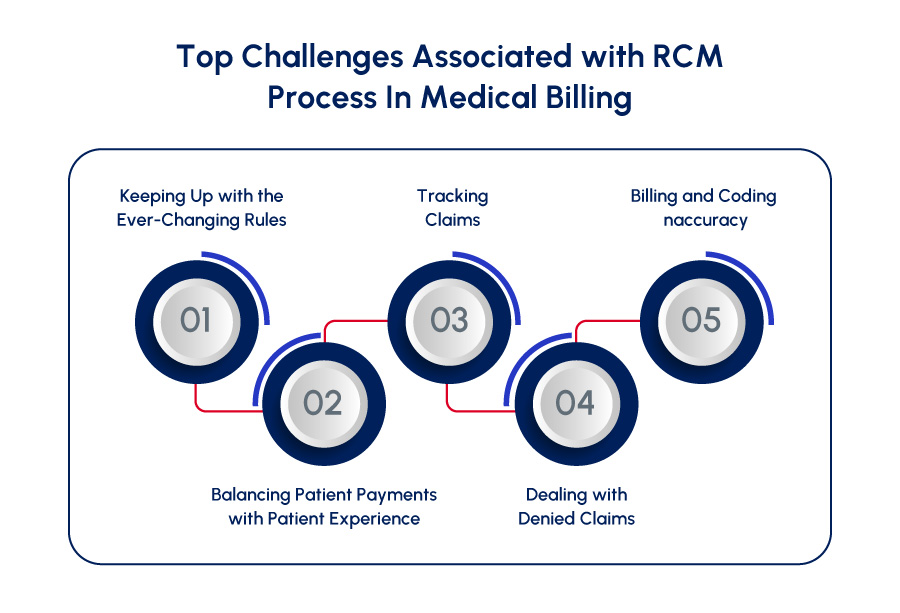

Challenges Associated with the RCM Process In Medical Billing

Fact Check: 52% of healthcare providers report that their payment collection process is their biggest RCM challenge in medical billing.

You see, getting paid often seems a complicated and arduous process.

This is where the need to optimize your practice’s RCM process comes in so you can streamline the collection process and get paid faster.

| Over 90% of hospital CFOs assert that if RCM operations were optimized, their organizations’ financial performance would improve. |

We have discussed some top challenges associated with RCM in medical billing along with the solutions for you to overcome these hurdles and make the collection process as smooth as possible.

Challenge #1: Keeping Up with the Ever-Changing Rules

The world of healthcare regulations and insurance reimbursement models seems to be constantly evolving. For medical practices, especially smaller ones, staying on top of these changes can be a challenge.

This can lead to errors and delays in getting paid.

- Complexity of Regulations and Payor Models: Healthcare regulations and insurance payer models such as Medicare and Medicaid guidelines are complicated and updated regularly. Understanding these updates and ensuring your staff stays updated as well is crucial for getting paid accurately.

The Solution?

- Investing in Staff Training and Resources: Equipping staff with the latest knowledge through regular training sessions and resource materials helps them navigate the complexities of RCM.

- Considering RCM Specialists: Partnering with an RCM specialist can be a strategic solution. These specialists stay current on regulatory changes and can ensure your practice adheres to the latest guidelines.

Challenge #2: Balancing Patient Payments with Patient Experience

With rising healthcare costs, patients are responsible for more out-of-pocket expenses. The challenge for providers is collecting these payments without being pushy or jeopardizing patient relationships.

- Finding the Right Balance: Finding a balance between collecting patient payments and maintaining a positive patient experience can be tricky. Aggressive collection tactics can damage trust.

The Solution?

- Offering Flexible Payment Options: Providing a variety of payment options, like installments or online payments, empowers patients to manage their out-of-pocket costs more easily.

- Clear Communication Upfront: Open communication regarding potential patient costs and insurance coverage expectations helps set clear boundaries and avoids surprises later.

Challenge #3: Tracking Claims

If a medical practice doesn’t have a system for monitoring claims after they’re submitted, errors or delays might go unnoticed. This can lead to lost revenue for the practice.

- Lack of Claim Tracking System: Without a system to track claims, it’s difficult to identify and address issues promptly, potentially leading to denials or delayed payments.

The Solution?

- Implementing a Claim Tracking System: A robust claim tracking system allows staff to monitor claims progress within the insurance company’s system. This enables timely follow-up and proactive intervention if delays or errors occur.

Challenge #4: Dealing with Denied Claims

Denied claims are a major frustration for both providers and patients. They can significantly impact a practice’s bottom line.

- High Rate of Denials: Denied claims can be caused by various reasons, like coding errors, missing information, or lack of authorization. Each denial represents lost revenue for the practice.

The Solution?

- Developing a Strong Denial Management Plan: An effective denial management plan involves a dedicated team trained to identify the root cause of denials, communicate with insurance companies, and file appeals if necessary.

Challenge #5: Billing and Coding Inaccuracy

Effective RCM requires well-trained staff who understand the billing and coding processes. Without proper training, errors can occur, leading to delays and lost revenue.

- Ensuring Billing and Coding Compliance: Claim denials resulting from inaccurate coding and billing result in using extra time, effort, and resources delaying your revenue cycle and reimbursements.

The Solution?

- Ongoing Training Sessions: Invest in ongoing training for your billing, coding, and RCM staff and help them stay updated with regulatory changes to adhere to the ICD-10, CPT, and HCPCS coding guidelines.

These are some of the most common challenges faced by providers in successfully managing their RCM process in medical billing.

By implementing the solutions above, healthcare providers can create a more efficient and streamlined billing process, ensuring they get paid for the services they deliver while providing a positive experience for their patients.

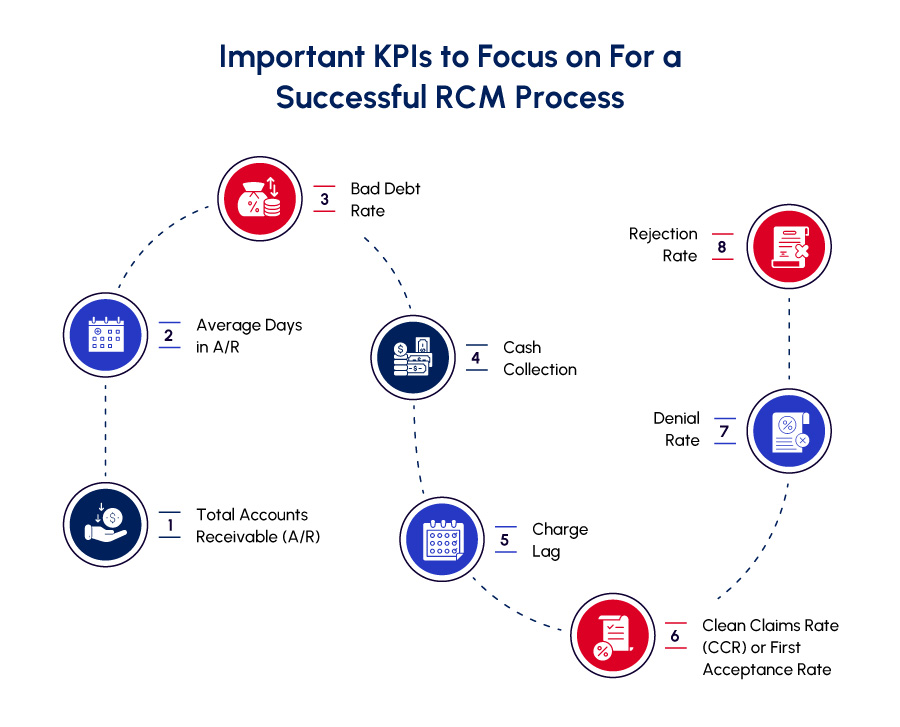

Important KPIs to Focus on For a Successful RCM Process

A smooth-running RCM (Revenue Cycle Management) process is essential for any healthcare provider.

But how do you know if your billing, coding, and RCM system is working fine?

Here, we’ll explore key performance indicators (KPIs) that can help you monitor your RCM’s health and identify areas for improvement.

KPIs to Focus On:

- Total Accounts Receivable (A/R): This represents the total amount of money owed to the practice by patients and insurance companies for delivered services. A high A/R amount could indicate potential issues with collecting payments or delays in claim processing.

- Average Days in A/R: This KPI measures how long it typically takes, on average, to collect on outstanding balances. A longer average indicates delays in the revenue cycle, potentially due to slow claim processing or inefficient billing practices.

- Bad Debt Rate: This represents the percentage of outstanding A/R that the practice is unlikely to collect. A high bad debt rate can significantly impact a practice’s financial health.

- Cash Collection: This KPI measures the total amount of cash collected from patients and insurance companies within a specific period. Monitoring cash collection helps ensure the practice has sufficient cash flow to operate smoothly.

- Charge Lag: This is the time difference between when a service is rendered to a patient and when the claim is submitted to the insurance company. A longer charge lag can lead to delays in receiving reimbursement.

- Clean Claims Rate (CCR) or First Acceptance Rate: This KPI reflects the percentage of claims submitted that are processed by the insurance company without errors or requests for additional information. A high CCR indicates efficient coding and billing practices.

- Denial Rate: This KPI measures the percentage of claims that are denied by insurance companies. A high denial rate suggests potential problems with coding, missing information, or lack of prior authorization.

- Rejection Rate: This refers to the percentage of claims that are rejected by the insurance company, typically due to administrative errors like incorrect patient information or missing attachments. Rejections can delay the claims process and require resubmission.

By tracking these KPIs regularly, healthcare providers can gain valuable insights into their RCM performance. This allows them to identify areas for improvement and implement strategies to optimize their revenue cycle, ensuring they get paid accurately and efficiently for the services they deliver.

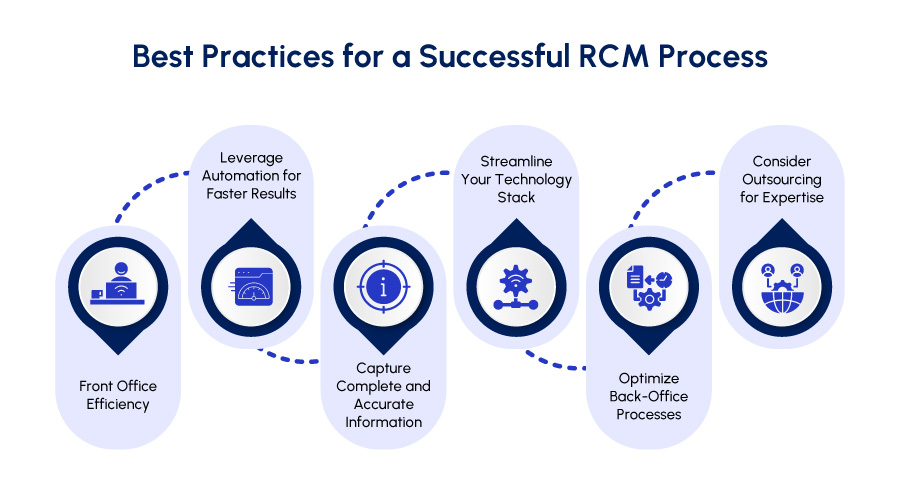

Best Practices for a Successful RCM Process

Ever felt like RCM in medical billing is an overwhelming puzzle?

Don’t worry, we have got you covered. Here are some practical tips to turn your RCM into a well-performed revenue collection cycle:

1. Front Office Efficiency

✔️ Train your front office staff to gather accurate patient insurance information upfront during appointment scheduling. This reduces errors and delays.

✔️ Utilize clear communication scripts to explain co-pay requirements and various payment options available to patients. A well-informed patient is a happy patient!

2. Leverage Automation for Faster Results

✔️ Automate insurance eligibility verification. This double win prevents claim errors and informs patients early about potential out-of-pocket costs, allowing them to plan accordingly.

| NOTE: About 70% of healthcare leaders claim that automation in RCM will play a significant role by 2025. |

3. Capture Complete and Accurate Information

✔️ Use and customize EMR templates to efficiently capture all necessary clinical documentation and billing data during patient visits.

✔️ Remind clinicians to document thoroughly and establish a review process to identify areas for improvement in documentation accuracy.

4. Streamline Your Technology Stack

✔️ Whenever possible, use an integrated Electronic Medical Record (EMR) system that seamlessly connects with your practice management software. This reduces manual data entry and minimizes errors.

5. Optimize Back-Office Processes

✔️ Embrace technology to automate claim submissions and utilize e-remittance options for faster payment processing.

✔️ Offer a convenient online patient payment portal for settling outstanding balances after visits.

✔️ Implement a system for managing insurance follow-up and claim denials to ensure timely resolution and improve cash flow.

✔️ Understand the power of data analytics. Regularly track reports to monitor revenue goals and identify areas for improvement within your RCM process.

6. Consider Outsourcing for Expertise

✔️ Evaluate RCM software solutions to find the right fit for your practice’s needs. The right software frees up your team to focus on patient care.

✔️ For practices lacking the resources or staff expertise, consider outsourcing RCM to an all-in-one medical billing company offering comprehensive billing, coding, and RCM services. This can be a strategic solution, especially for smaller practices.

By implementing these practices, you can transform your RCM into a smooth-running system. A well-functioning RCM is essential for ensuring your practice receives timely and accurate payments, allowing you to focus on what matters most – delivering exceptional patient care.

Streamline Your Revenue Cycle with Med Billing TX

| Hospitals that optimize their RCM processes can possibly increase their revenue by as much as 3-5%. |

At Med Billing TX, we understand the complexities of medical billing. We leverage cutting-edge technology and experienced billing specialists to empower your practice and maximize your revenue through our RCM services in Texas.

Here’s how Med Billing TX can transform your RCM (Revenue Cycle Management):

| ✅ Boost Efficiency and Accuracy: Our technology automates tedious tasks and ensures claims are submitted accurately and on-time, minimizing denials and delays. ✅ Texas Expertise: Our team stays current on state and payer policies specific to Texas, ensuring your practice adheres to the latest regulations. ✅ Specialty-Specific Support: We have experienced billers dedicated to your practice area, providing in-depth understanding of your unique billing needs. ✅ Real-Time Insights: Gain real-time performance analytics and timely alerts to ensure no claim goes unnoticed. |

Partner with Med Billing TX and get paid faster and exactly what you deserve while focusing on what matters most – delivering quality patient care. Let us handle the complexities of medical billing and offer you a free medical billing audit.