EOB, also known as Explanation of Benefits (EOB), is a crucial document in the medical billing process. To streamline the billing process, the providers must collaborate with the patients as well as the insurance payers to address the errors in the EOB.

With our expert staff and professional medical billing company in Texas you get to properly examine EOB, implement the fixes, proceed with the payments, and maximize the insurance benefits.

Let’s go through this document, and become a more informed healthcare provider and consumer to ensure getting the most out of an insurance plan.

What Is EOB In Medical Billing?

An EOB is a statement issued by the health insurance company that explains how they handled a claim submitted by the healthcare provider.

👉 It is a detailed explanation of how the insurance plan is applied to the patient’s medical care.

Understanding the EOB workflow is essential and our free medical billing audit empowers both the providers and the patients to make informed decisions about their healthcare finances.

An EOB briefly outlines the following key information:

✔️ Services Billed: This section lists the specific medical services or procedures the doctor or hospital is charged for.

✔️ Costs Involved: The EOB details the total charges associated with these services.

✔️ Insurance Coverage: It shows how much the insurance plan covers for each service, including any deductibles, co-pays, or coinsurance applied. This helps the patient understand how much the insurance helped balance the costs.

✔️ Patient Responsibility: The EOB will clearly state the amount the patient is responsible for paying. This is often referred to as an “out-of-pocket” expense.

The Difference between a Bill and an EOB (Explanation of Benefits)

EOB is not a bill but a breakdown of how the insurance claim was processed and what the patient owes to the healthcare provider.

A medical bill, however, is a statement from the healthcare provider (doctor, hospital, etc.) listing the services the patient received and the associated charges. It essentially outlines what the patient owes the provider for the services rendered.

An EOB vs. a Bill

| Feature | EOB (Explanation of Benefits) | Bill |

| Who Sends it? | Health insurance company | Healthcare provider (doctor, hospital, etc.) |

| Purpose | Explains how your insurance processed a claim | Requests payment for services rendered |

| Information Provided | Service details, costs involved, insurance coverage, patient responsibility | Service details, charges, total amount due |

| Items | Date of service, type of service, provider, charges from the provider, what insurance is covered, and what the patient owes | Date of service, type of service, total charges, and patient’s specific payment responsibility (deductibles, copayments, etc.) |

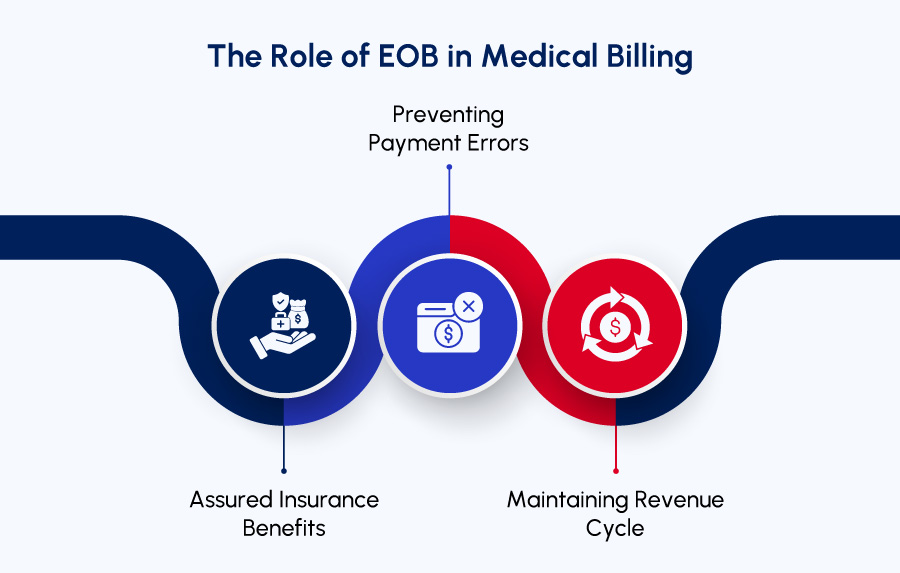

The Role of EOB in Medical Billing

Navigating the world of medical billing can be confusing, especially when dealing with insurance. Here’s how an Explanation of Benefits (EOB) plays a crucial role in ensuring a smooth and accurate process:

Assured Insurance Benefits:

EOB is the detailed record of the benefits applied to the claim based on the specific health insurance plan. Allowing the patients to verify if their eligible benefits were accounted for.

This transparency ensures every eligibility and benefit is processed correctly, eventually minimizing the risk of missed coverage.

Preventing Payment Errors:

EOBs prevent overpayments or underpayments on medical bills.

If errors arise between the EOB and the final bill, the patient has the right to question both the provider and the insurance company. Ultimately, the patient is responsible for paying the accurate amount owed.

Maintaining Revenue Cycle:

EOBs play a vital role in maintaining the healthcare revenue cycle. Upon receiving the EOB alongside their final bill, it’s important for patients to compare the information and report any discrepancies.

If everything goes well, prompt payment ensures healthcare providers receive fair compensation for their services. This prevents financial losses and ensures a smooth revenue flow.

For a smooth revenue flow get a free medical billing practice audit to identify any discrepancies during or after the submission and EOB generation process.

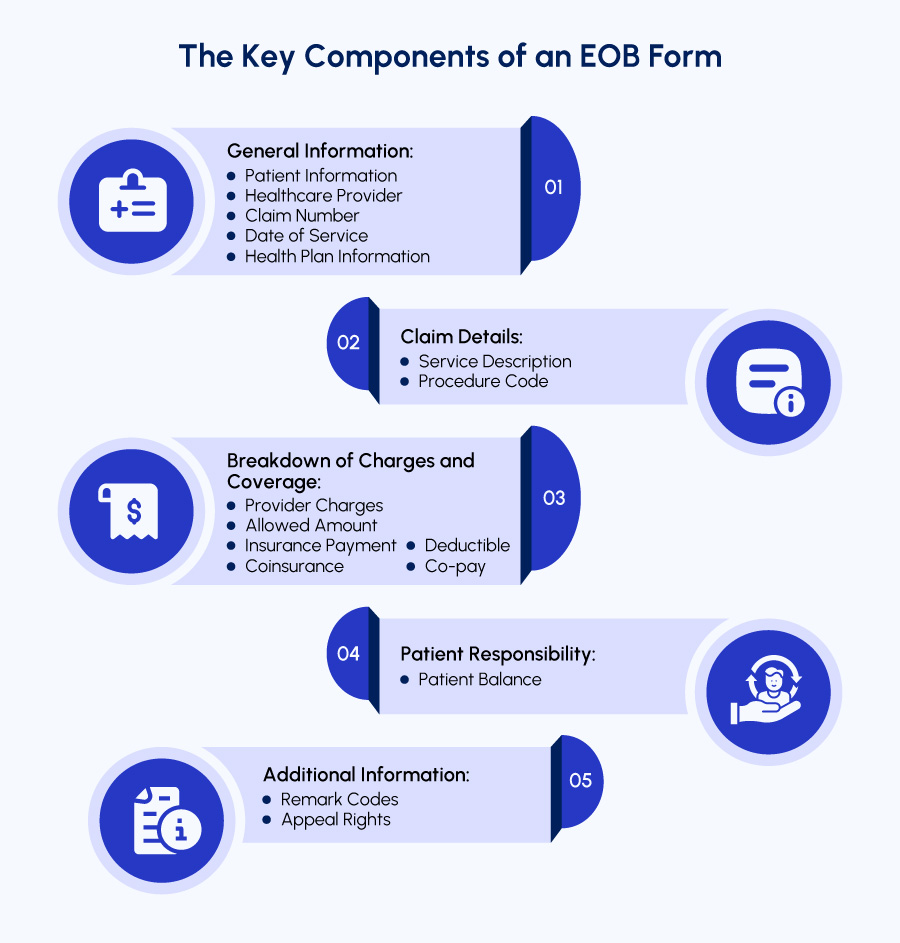

The Key Components of an EOB Form

An Explanation of Benefits (EOB) can feel like a complex maze at first glance. Well, it does not have to. Here’s the list of key components of an EOB, helping patients understand the details of healthcare benefits:

1. General Information:

➡ Patient Information: This section identifies the patient, including name, address, and insurance ID number.

➡ Healthcare Provider: Details about the doctor, hospital, or clinic that provided care.

➡ Claim Number: A unique identifier assigned to the patient claim by the insurance company.

➡ Date of Service: The specific date(s) the healthcare services were rendered.

➡ Health Plan Information: Contact details for specific health insurance plans, in case the patient has any questions.

2. Claim Details:

➡ Service Description: A brief explanation of the medical services the patient received (e.g., doctor’s visit, lab test, X-ray).

➡ Procedure Code: A standardized code that identifies the specific medical service performed. May not see this on all EOBs.

3. Breakdown of Charges and Coverage:

➡ Provider Charges: The total amount the healthcare provider billed for the services.

➡ Allowed Amount: The amount the insurance company agrees to pay for the service (may differ from provider charges). This considers negotiated rates or network participation.

➡ Insurance Payment: The amount the insurance plan actually pays the provider.

➡ Deductible: The initial amount the patient is responsible for paying before the insurance starts covering costs (if applicable to the plan).

➡ Co-pay: A fixed dollar amount the patient pays for certain covered services at the time of service (if applicable to the plan).

➡ Coinsurance: A percentage of the allowed amount that the patient is responsible for paying after their deductible is met (if applicable to the plan).

4. Patient Responsibility:

➡ Patient Balance: This clearly states the amount the patient is responsible for paying after all insurance coverage is applied.

5. Additional Information:

➡ Remark Codes: Some EOBs may include short alphanumeric codes that explain specific details about the costs, charges, or payments. There should be a legend on the EOB itself to decipher these codes.

➡ Appeal Rights: Information about the patient’s right to appeal a denial of coverage or any aspect of the claim processing.

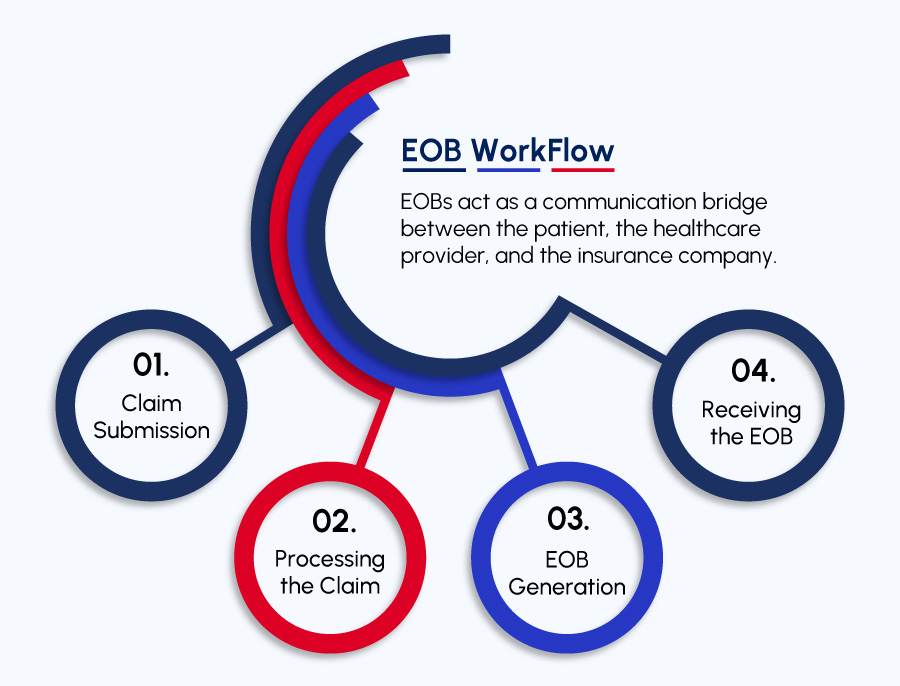

How Does EOB Work?

Do you Know?

| EOBs act as a communication bridge between the patient, the healthcare provider, and the insurance company. |

By understanding the EOB workflow and the information it provides, the patients as well as providers are empowered to make informed decisions about their healthcare finances and ensure clarity throughout the medical billing process.

Here’s a breakdown of the an EOB workflow:

1. Claim Submission:

- Once the healthcare service is delivered, the provider submits a bill to the insurance company. This bill details the services rendered and the costs.

2. Processing the Claim:

- The insurance company receives the bill and initiates the claim processing stage. This involves verifying patient eligibility, reviewing the services provided against patient plan coverage, and applying any relevant deductibles, co-pays, or coinsurance.

3. EOB Generation:

- Once the claim is processed, the insurance company generates an EOB. This document outlines how the specific health plan handled the charges associated with the healthcare visit. Explaining how the claim is processed.

4. Receiving the EOB:

- The patient typically receives the EOB by mail or electronically within a few weeks of their visit. The timeframe may vary depending on the insurance company’s processing procedures.

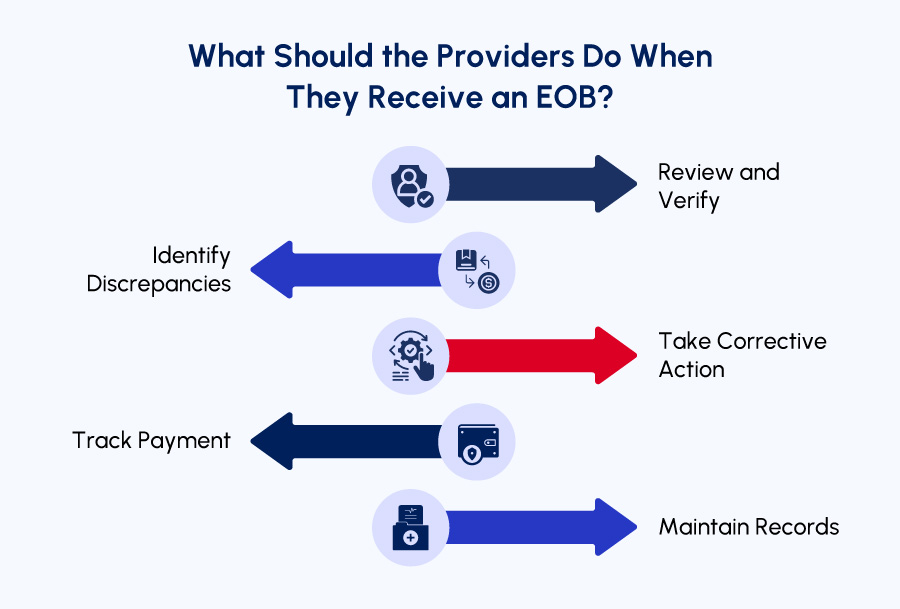

What Should the Providers Do When They Receive an EOB?

As a healthcare provider, receiving an Explanation of Benefits (EOB) from an insurance company is a crucial step in the medical billing process.

Here’s what you are suggested to do once you receive an EOB:

1. Review and Verify:

- Carefully review the EOB to ensure the information aligns with the services you provided to the patient.

- Verify details like patient demographics, service dates, and procedure codes match your records.

2. Identify Discrepancies:

- Look for any inaccuracies between the EOB and your original bill. This could include:

➡ Incorrect service descriptions or codes.

➡ Differences in billed charges compared to the allowed amount by the insurance company.

➡ Errors in calculating deductibles, co-pays, or coinsurance.

3. Take Corrective Action:

- If you see any errors, it’s crucial to take immediate action.

➡ For minor errors, you can directly contact the patient to explain the difference and adjust the bill accordingly.

➡ For prominent issues, reach out to the insurance company to discuss the issue and resolve it.

4. Track Payment:

- Track the payment received from the insurance company by carefully monitoring the EOB.

- Depending on your agreement with the patient, you may need to collect any remaining patient responsibility (balance) after insurance coverage.

5. Maintain Records:

- Keep a record of the EOB alongside the original patient bill for future reference. This documentation helps in case of any inquiries from the patient or insurance company.

Conclusion

Lastly, an EOB is not a bill, but a valuable tool for understanding how the insurance handled the claim. By familiarizing with the key sections and components of an EOB, the patient as well as the provider can gain valuable insights into healthcare finances.

Need more information or have any questions?

Contact our experts at Med Billing TX who have the knowledge and experience to help you process payments using our integrated EHR software.