Have you ever wondered how medical bills get paid when a patient has multiple health insurance plans?

Well, just so you know, approx. 43 million people or about 14% of Americans had multiple insurance payers in 2021.

Multiple insurance payers create confusion between who is primary and secondary payer.

Now, that’s where COB, or Coordination of Benefits, comes in. And with our medical billing services in Texas, providers get to submit accurate claims and prevent overpayment, while avoiding denials.

COB in Medical Billing

It’s like a traffic police, directing each insurance company – primary and secondary payer, on how much they owe for a patient’s medical services.

In simplified terms, the COB in medical billing helps you with:

1). Multiple Insurance, One Patient: If a patient has more than one health insurance plan – primary and secondary, COB helps determine which plan pays first and which one contributes next.

2). Preventing Double Payments: COB ensures each insurance company pays their fair share while preventing them from paying for the entire bill twice.

3). Clearing Up Confusion: COB helps providers bill the correct payers even if the patients forgets about their primary or secondary insurance options.

The Purpose of COB in Medical Billing

Preventing overpayment and ensuring accuracy is the main reason insurance companies use COB. Here’s why Insurance companies need COB;

👉 Stops Duplicate Payments: COB prevents both insurance companies from accidentally paying the entire bill. It ensures each company pays their fair share, based on their coverage policies.

👉 Promotes Accuracy: COB helps identify the correct primary insurance company, which should pay first. This minimizes errors and ensures your claims get processed smoothly.

👉 Faster Reimbursements: Knowing which insurance is primary and which one secondary, helps get claims processed and paid more quickly. Which means faster cash flow for your practice.

👉 Reduced Errors and Delays: COB minimizes confusion as well as billing errors, preventing denials and delays because of the confusion between primary and secondary payers.

👉 Peace of Mind for Everyone: A clear understanding of COB ensures that the provider and the patient are on the same page. Eliminating the hassle of chasing payments.

The Role of COB in Medical Billing

Coordination of benefits helps identify any changes in coverage or inaccuracies that could lead to major denials or delays. Most importantly, COB explains for patients with Medicare and other insurance, which plan pays first and which second.

While you typically don’t need to worry about the complex calculations of COB, understanding its purpose empowers to:

- Answer patient questions about insurance coverage.

- Ensure your billing system or clearinghouse is ready to handle COB correctly.

- Avoid delays and frustrations associated with claim processing.

The Step-by-Step COB Workflow in Medical Billing

- Claim Submission: Submission of the patient’s medical bill to their primary insurance company.

- Primary payer pays: The primary insurance reviews the claim and pays what they’re responsible for according to their plan.

- Secondary Payer Pays Its Share: If there’s an outstanding balance it’s sent to the secondary payer, who reviews the claim and according to their plan, covers remaining costs.

Common COB Scenarios:

- Family Coverage: Children covered under both parents’ plans.

- Dual Coverage: Someone covered by both Medicare and an employer plan.

- Dependent Coverage: A spouse covered under both their own plan and their partner’s plan.

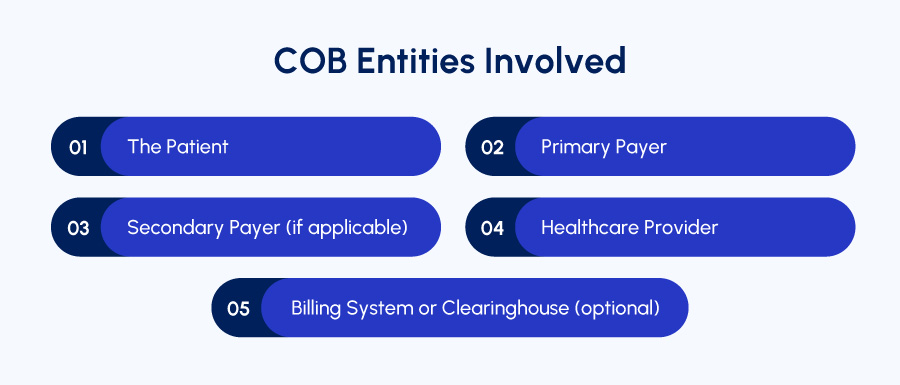

COB Entities Involved

In medical billing, COB stands for Coordination of Benefits. It makes sure each insurance company involved in a patient’s care pays their fair share.

These are the directly involved COB entities:

- The Patient: The person receiving medical care and has single or multiple health insurances.

- Primary Payer: It is responsible for paying first for the patient’s medical services. COB helps determine which plan is primary based on factors like employment status, age, and plan rules.

- Secondary Payer: If the patient has a second health insurance plan, it becomes the secondary payer. The secondary payer enters in the scene only after the primary payer has paid their portion of the bill.

- Healthcare Provider: The medical practice that provides the care to the patient and submits the claim to the insurance company involved.

- Billing System or Clearinghouse: Some medical providers use a billing system or clearinghouse to handle the claims submission process.

These entities help manage COB by identifying the correct payers and submitting accurate claims.

For Example, a patient named Sarah visits the clinic for a checkup..

She has two insurance plans: one from her employer and another from her spouse’s employer.

COB helps determine that her employer’s plan is the primary payer (because it’s likely the plan she gets as an employee). So, you would submit the claim to her employer’s insurance first.

- Scenario 1: If her employer’s plan covers the entire cost of the checkup, then there’s no need to involve the secondary plan.

- Scenario 2: If the checkup costs more than her employer’s plan covers, the remaining balance would be sent to her spouse’s plan (the secondary payer) for them to consider covering.

How to Identify Primary and Secondary Insurance?

Figuring out which insurance company pays first (primary) and which one pays next (secondary) can be daunting.

- The Birthday Rule: The parent whose birthday falls earlier in the year (month and day only) has the primary plan. The other parent’s plan becomes secondary.

- Exceptions: If parents share a birthday, the plan that’s been in effect longer is termed as primary.

- Divorced Parents: A court order might dictate the primary plan. In its absence, the birthday rule applies.

- COBRA and Young Adults: If one parent is on COBRA, the other parent’s plan is always primary.

- Married Young Adults: If a young adult (under 26) has both a spouse’s and parent’s plan, the plan in effect longer is primary. If they have their own employer plan, that becomes primary, and the parent/spouse’s plans become secondary.

However, specific details regarding COB rules can vary depending on:

- Location: State laws can influence COB rules.

- Insurance Plan Details: Each insurance plan has its own COB provisions outlined in the plan documents.

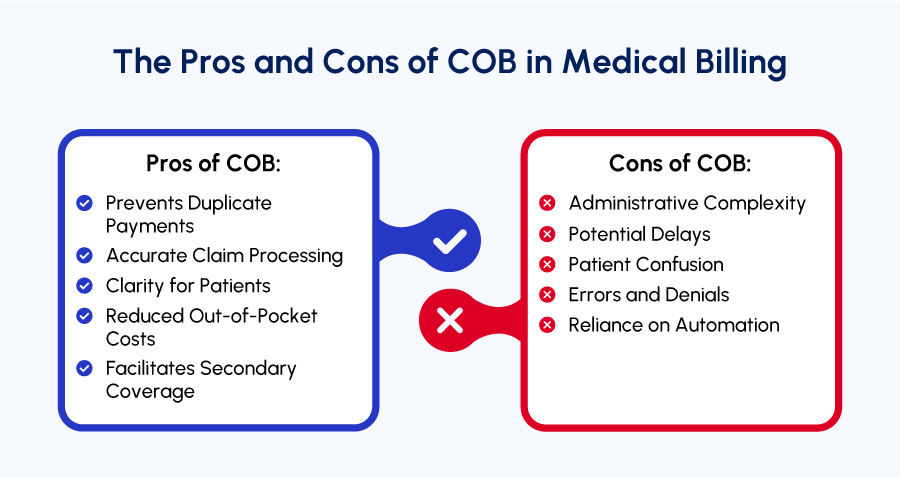

The Pros and Cons of COB in Medical Billing

Coordination of Benefits (COB) plays a crucial role in medical billing, ensuring patients with multiple insurance plans receive proper coverage and preventing overpayment for services. However, it also comes with its own complexities.

Below are the advantages and disadvantages of COB:

Pros of COB:

✔️ Prevents Duplicate Payments: COB ensures each insurance company pays their share, eliminating the risk of double payment for medical services, while protecting both patients and insurance companies from financial strain.

✔️ Accurate Claim Processing: By identifying the correct primary payer, the errors can be minimized and smooth processing of claims is ensured. Which means reduced delays and continually moving revenue cycle.

✔️ Clarity for Patients: COB helps patients understand who their primary insurance carrier is and what coverage they can expect leading to reduced confusion and financial decline.

✔️ Reduced Out-of-Pocket Costs: For patients with multiple plans, COB ensures they receive maximum coverage, potentially minimizing their out-of-pocket costs for medical services.

✔️ Facilitates Secondary Coverage: COB allows patients with secondary insurance to have additional coverage after the primary plan has paid its portion.

Cons of COB:

❌ Administrative Complexity: COB can introduce additional administrative tasks for medical providers. Identifying the correct payers, submitting claims to each entity, and following up on COB issues can be time-consuming leaving providers distracted from their core tasks.

❌ Potential Delays: Resolving COB issues can lead to claim processing delays. Waiting for insurance companies to determine payment responsibility can hold up reimbursements for providers.

❌ Patient Confusion: Multiple plans can cause all the confusion to the patient about their primary and secondary plan despite the clarity offered by COB.

❌ Errors and Denials: Misunderstandings or inaccuracies in COB and claims processing can lead to denials or incorrect payments. Which means additional effort from providers and frustration for patients.

❌ Reliance on Automation: Effective COB management often relies on sophisticated billing software or clearinghouses. These can involve additional costs for medical practices.

Despite the challenges, COB plays a vital role in medical billing to ensure fair and accurate payment for medical services in a multi-payer healthcare system.

Does Coordination of Benefits (COB) leave you scratching your head?

Med Billing TX is here to untangle the complexities and ensure you receive the reimbursements you deserve.

Here’s how our staff can help:

- Expert Revenue Cycle Consulting: Our team of seasoned professionals offers personalized guidance to navigate any COB challenges in medical billing.

- Automated Solutions: Leverage the power of automation to streamline COB identification and resolution, saving you valuable time and resources.

- Real-Time Dashboards: Gain instant insights into your COB activity with our user-friendly dashboards, empowering informed decision-making.

- Proven Templates: Utilize our pre-built templates to ensure accurate claim submissions for all COB scenarios.

Our staff is committed to your success. Outsource or learn valuable billing best practices to maximize your revenue cycle.

Partner with Med Billing TX today and don’t let COB hold your practice back.