Being the intermediary between healthcare providers and insurance companies, a clearinghouse ensures seamless claim submissions and revenue collection in the world of medical billing.

You see, claim submission can be a tedious task, however, clearinghouses at Med Billing TX, offer numerous benefits that streamline healthcare reimbursement for providers.

Let’s find out how they work, their benefits to providers, and features that are revolutionizing the healthcare industry.

How Does a Clearinghouse in Medical Billing Work?

👉 Imagine a bridge connecting a busy highway – healthcare providers, with an intricate network of local roads – insurance companies.

This bridge is the clearinghouse. It facilitates the safe and smooth flow of medical claim data. With our medical billing services in Houston, avail different types of clearinghouses to handle various claim formats, such as pharmacy, dental, and facility claims.

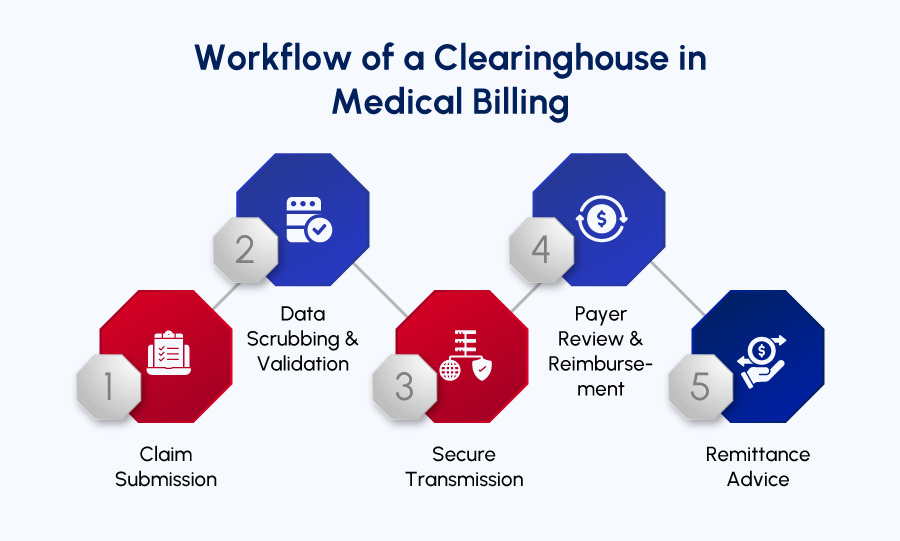

Here’s the workflow of a clearinghouse that streamlines the medical billing process:

- Claim Submission: Forget paper submissions with the advent of electronic clearinghouses in the healthcare industry. Now, healthcare providers submit claims electronically to their preferred clearinghouse, speed up the process, while eliminating the tediousness of paper submissions.

- Data Scrubbing & Validation: Clean claim submission is the goal here. The clearinghouse carefully scans, identifies, and scrubs the claims for errors and possible discrepancies. They are expected to check for missing or inaccurate information, incorrect coding especially – a common culprit for claim denials, to finally make sure the information given aligns and is compliant to the healthcare industry standards.

| Note: A clearinghouse in action significantly reduces delays, and denials in the reimbursement process. |

- Secure Transmission: Once the claims are scrubbed to accuracy, the clearinghouse passes them on securely to the respective insurance payers. Strict adherence to HIPAA compliance is ensured to safeguard sensitive patient data.

- Payer Review & Reimbursement: The insurance payers receive the claims, analyze the eligibility coverage based on the patient’s plan, and determine the payment amounts. The clearinghouse plays a supportive role by presenting the information in a standardized format, making it easier for payers to process claims efficiently.

- Remittance Advice: once the claims are reviewed, the insurance company sends remittance advice – an explanation of payment or denial, back to the clearinghouse. The information is transferred to the provider and based on the claim status, the provider either analyzes the claim for further accuracy in case of denials or receives the collection if accepted.

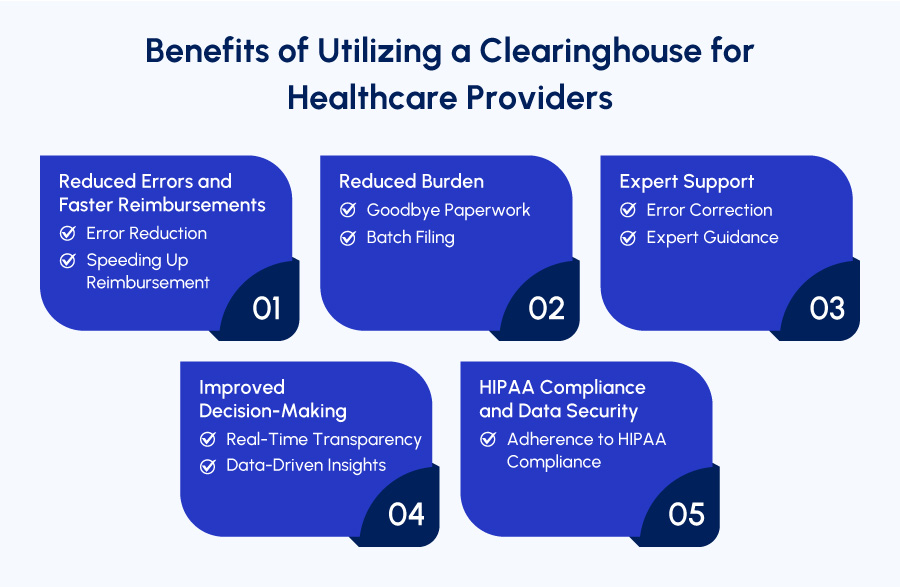

Benefits of Utilizing a Clearinghouse for Healthcare Providers

Utilizing a medical billing clearinghouse offers a plethora of advantages for healthcare providers. From streamlined workflows and reduced errors to faster reimbursements and enhanced compliance, clearinghouses empower providers to focus on delivering exceptional patient care with peace of mind.

Let’s look at the advantages of utilizing a clearinghouse in medical billing:

1. Reduced Errors and Faster Reimbursements:

✔️ Error Reduction: Being the meticulous editors, clearinghouses carefully scrub claims for errors and inconsistencies in coding, missing information, and formatting issues. This helps reduce claim denials – a common roadblock to timely revenue collections.

✔️ Speeding Up Reimbursement: Minimized errors and accurate claims submission upfront through the clearinghouse expedites the processing time by insurance companies. Which means reduced denials, faster reimbursements, and improved cash flow.

2. Reduced Burden:

✔️ Goodbye Paperwork: Clearinghouses ease the submission process using electronic claim submission, while eliminating the hassles of paper-based claims and manual scrubbing. It means reduced administrative burden for the healthcare staff and focused attention and quality care.

✔️ Batch Filing: Batch filing with clearinghouses allows you to submit multiple claims to multiple payers because gone are the days of sorting claims for individual insurers.

3. Expert Support:

✔️ Error Correction: Even the most streamlined and carefully crafted claims can have discrepancies and clearinghouses act as a game changer for them. Being the safety net, clearinghouses catch errors before submission.

✔️ Expert Guidance: Expert guidance and customer support comes in handy with some of the clearinghouses. Their help in billing, coding, and RCM ensure 100% reliability and zero inconsistencies.

4. Improved Decision-Making:

✔️ Real-Time Transparency: Streamlined claim processing through clearinghouses ensures thorough financial transparency. Offering a clear picture of the financial situation for the patients as well as providers.

✔️ Data-Driven Insights: Data driven-insights delivered by the clearinghouses also provide analytics and reporting tools. Allowing the providers to identify areas for improvement and making informed decisions using the insights.

5. HIPAA Compliance and Data Security:

✔️ Adherence to HIPAA Compliance: Compliance with the latest coding standards and HIPAA rules is primarily the most essential component of clearinghouses to ensure data security and accuracy for highest claim acceptance rate.

By leveraging the multifaceted benefits of medical billing clearinghouses, healthcare providers can achieve a more efficient, error-free, and financially sound billing process.

Role of a Clearinghouse in Medical Billing

Navigating the claim submission process can be a maze-like journey in medical billing. Fortunately, clearinghouses in medical billing emerge as guiding tools, ensuring efficient claim processing for both healthcare providers and insurance companies.

These are the roles and responsibilities of a clearinghouse in medical billing and revenue collection:

1). Data Scrubbing and Validation

- Error Eradication Specialists: Being the keeper and transmitter of the healthcare data, clearinghouses employ meticulously examining and scrubbing the information for inaccuracies. Proactively identifying the data leads to reduced denial rate.

2). Electronic Claims Submission

- Reduced Administrative Burden: The role of a clearinghouse begins with creating ease for the provider and the payer and goes beyond taking over the non-clinical duties of the healthcare staff. The electronic submission says farewell to the paper-work while freeing up the staff’s administrative burden.

3). Secure Transmission:

- HIPAA Compliance: Clearinghouses prioritize HIPAA compliance, ensure encryption of the sensitive patient data, and maintain secure transmission throughout claims processing.

4). Real-Time Status Updates:

- Transparency Throughout the Process: Staying informed and updated with the claim status is essential throughout the claim processing and a robust clearinghouse does just the same. It is more like a communication channel between the providers and the insurance payer updating with the acceptance or rejection.

5). Enhanced Revenue Cycle Management:

- Faster Reimbursements, Improved Cash Flow: Expedited claim submission and reduced errors by clearinghouses ensure enhanced revenue cycle and improved cash flow enabling financial clarity for all parties involved.

6). Additional Services Offered by Premium Clearinghouses:

- Eligibility Verification: Eligibility services offered by clearinghouses verify that patients are covered under the insurance plans even before the services are rendered. Staying vigilant over this minimizes the chances of denials due to coverage issues.

- Electronic Remittance Advice (ERA): Another important role played by the clearinghouse is automatically updating the patient accounts with the remittance details while accurately providing teh electronic remittance advice (ERA).

- Claim Status Reporting: Being aware of the claim status at all times is crucial for a positive financial performance while empowering the healthcare providers. This helps identify the roadblocks in the revenue cycle process.

- Rejection Analysis: Effective clearinghouses often provide user-friendly explanations for claim rejections, enabling healthcare providers to rectify errors and resubmit claims quickly.

- Online Claim Management: Some clearinghouses provide online portals for healthcare providers to submit, track, and even correct claims electronically, enhancing convenience and accessibility.

Medical billing clearinghouses serve as a foundation of a streamlined and efficient revenue cycle management system.

By using its expertise in data validation, secure communication, and advanced features, healthcare providers can navigate the complexities of medical billing with increased confidence, and ensuring timely reimbursements.

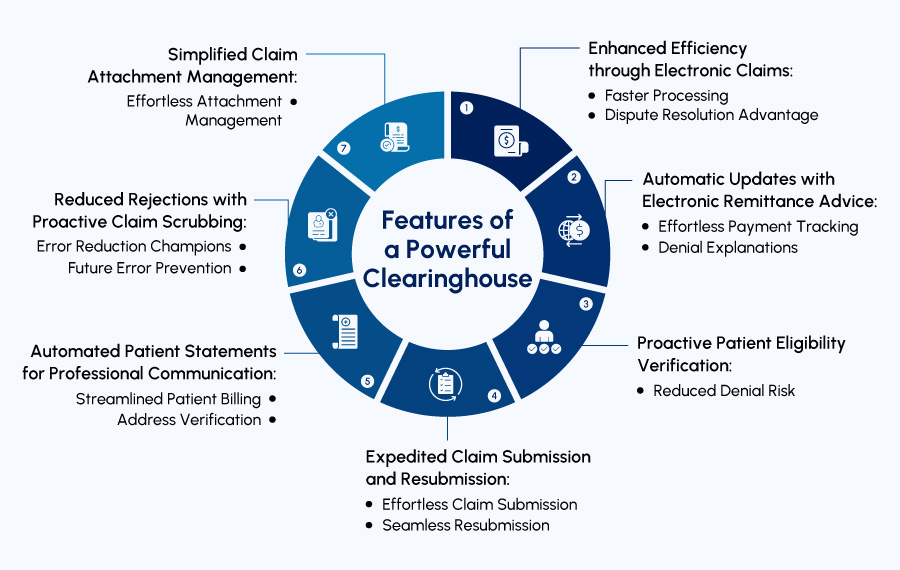

Streamlined Medical Billing with Powerful Clearinghouse Features

Medical billing clearinghouses offer a comprehensive suite of features designed to simplify and expedite the claims processing journey. Let’s explore its value-added functionalities:

1. Enhanced Efficiency through Electronic Claims:

- Faster Processing: Clearinghouses have reduced the submission and claim processing time as compared to the manual processing done via traditional paper method. It means enhanced efficiency and faster cash flow.

- Dispute Resolution Advantage: Electronically submitted claims create a clear audit trail, streamlining the process of resolving any disputes that may arise with insurance companies.

2. Automatic Updates with Electronic Remittance Advice (ERA):

- Effortless Payment Tracking: ERA automates the process of updating patient accounts with payment details. This ensures accurate record-keeping and eliminates the need for manual data entry.

- Denial Explanations: In case of claim denials, ERA provides valuable insights into the reason for rejection, empowering you to take corrective actions and resubmit claims promptly.

3. Proactive Patient Eligibility Verification:

- Reduced Denial Risk: Proactively verifying patient eligibility can be a game changer for the provider as well as the patient as it helps avoid denials. Once the eligibility is verified the clearinghouse enables the providers to schedule appointments with ease and peace of mind.

4. Expedited Claim Submission and Resubmission:

- Effortless Submission and resubmission: Electronically submit and resubmit claims quickly and efficiently through the clearinghouse platform in case of rejections.

5. Automated Patient Statements for Professional Communication:

- Streamlined Patient Billing: Clearinghouse services can automate the generation and mailing of patient statements, ensuring timely communication and accurate billing information.

- Address Verification: Many clearinghouses offer address verification services to minimize errors and ensure statements reach patients promptly.

6. Reduced Rejections with Proactive Claim Scrubbing:

- Error Minimizer: Clearinghouses meticulously scrub claims for errors and inconsistencies in billing, coding, patient information, etc. This proactive approach significantly reduces claim rejections, saving you time and money used for resubmissions.

- Future Error Prevention: The clearinghouse software works with attention to detail so much as to analyze previously rejected claims and identify patterns to prevent similar future errors.

7. Simplified Claim Attachment Management:

- Effortless Attachment Management: Some claims require additional documentation (e-attachments). Clearinghouses facilitate the easy attachment of these electronic documents to your claims, ensuring a complete submission.

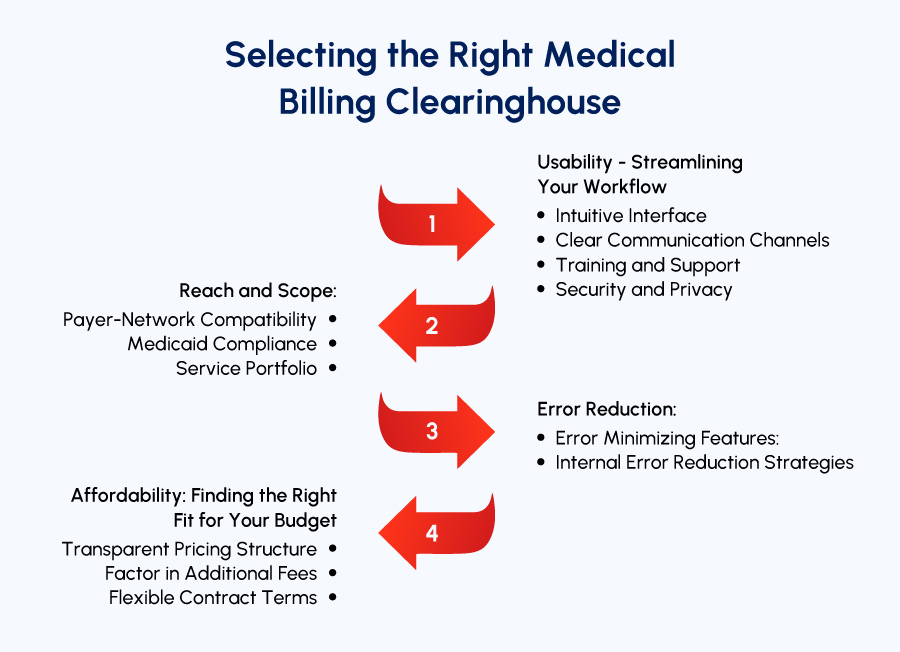

Selecting the Right Medical Billing Clearinghouse:

Choosing the ideal medical billing clearinghouse empowers healthcare providers to streamline claim processing, expedite reimbursements, and focus on delivering exceptional patient care.

Here’s a detailed breakdown of key points to guide your selection process:

1. Usability – Streamlining Your Workflow

➡ Intuitive Interface: A user-friendly interface is a win-win. Look for a clearinghouse that offers an intuitive claims dashboard for easy claim management for payers as well as providers in one centralized location.

➡ Clear Communication Channels: Effective communication is crucial. The clearinghouse should be able to provide clear protocols for verifying, correcting, and adding missing information. At-a-glance error reports and claim status updates are valuable assets, minimizing delays and facilitating staff progress updates.

➡ Training and Support: Seamless onboarding is essential. The clearinghouse should offer comprehensive training materials and real-time support to empower your staff and ensure efficient platform utilization. Responsive call center support with minimal wait times allows for prompt resolution and troubleshooting.

➡ Security and Privacy: Patient data security is an absolute priority therefore, look for features like:

- Data Encryption: Uses the industry-standard encryption protocols during transmission.

- Access Control: Minimizes unauthorized access risks and limits the user access to specific features based on the roles.

- Audit Trails: Comprehensive audit trails track user activity for monitoring and compliance purposes. Regular security audits and assessments further strengthen security posture.

2. Reach and Scope:

➡ Payer-Network Compatibility: Aligning the clearinghouse with the claim submission needs is crucial for error-free processing. Verify that the clearinghouse connects to all regular payers, eliminating the need for additional vendors. Different clearinghouses may specialize in specific claim types or operate within specific regions. Choose the one with a broader reach that handles all claim types.

➡ Medicaid Compliance: If you submit Medicaid claims, ensure the clearinghouse is set up to do so in accordance with state requirements.

➡ Service Portfolio: Consider the services you require: electronic claim submission, patient eligibility verification, claim status tracking, or ERA receipt functionality. Some clearinghouses offer a comprehensive set of operational functionalities, while others focus on certain aspects only.

3. Reduced Inaccuracies:

➡ Error Minimizing Features:

😱 80% medical bills contain errors.

Therefore, the clearinghouse you need to choose must have features that minimize claim errors, such as duplicate information checks, missing attachment detection, and coding discrepancy identification. An error-identifying dashboard enables immediate correction, preventing delays associated with late error discovery.

➡ Internal Error Reduction Strategies: Complement the clearinghouse’s error-minimizing features with your own in-house efforts. Tools like Claim scrubber can verify patient information and coding entries before submission, reducing errors upfront. Automated Prior Authorizations and Insurance Eligibility Verification tools offer additional layers of verification throughout the patient journey.

4. Affordability: Finding the Right Fit for Your Budget

➡ Transparent Pricing Structure: Cost is a prominent factor when choosing a clearinghouse. Opt for the one with a transparent pricing structure. Some charge a fixed monthly fee, while others have variable fees based on claim volume. Choose a fixed fee for practices with lower claim volumes.

➡ Factor in Additional Fees: Identify potential extra fees associated with services like eligibility checks, claim status updates, and remittance receipts during contract negotiations.

➡ Flexible Contract Terms: Avoid long-term contracts with unclear termination clauses. The healthcare landscape is constantly evolving, so flexibility is key.

A Clearinghouse that Delivers Value-Added Features

Our free medical billing audit examines the medical billing KPIs for practices and helps streamline their billing, coding, and RCM processes.

Let’s find out why healthcare providers should strongly consider utilizing Med Billing TX clearinghouse:

- Eligibility Verification: Verify your patient insurance coverage before appointments to prevent claim denials due to ineligibility.

- Electronic Remittance Advice (ERA): Automate the process of updating patient accounts with payment details, and save time and effort used in manual data entry.

- Claim Status Reporting and Analysis: Gain real-time insights and report into claim status and identify areas for improvement in your claim submission.

- Online Claim Management: Submit, track, and even correct claims electronically through a convenient online portal.